$0 Down & Limited-Time Savings—Talk to a Land Expert Today!

Owning land in Texas comes with great perks—especially when it comes to property taxes. The agricultural exemption, or “ag exemption,” lets qualifying agricultural land be taxed based on its productive value instead of its market value, saving landowners money.

With the 2025 application window already open (typically from January 1st to April 30th), now is the perfect time to get started if you have not already. Whether you are maintaining an existing exemption or applying for the first time, gathering the right documentation and understanding your property’s agricultural use will ensure a smooth application process.

Below, we have broken down the key details you need to confidently navigate the ag exemption process this year.

Any change in property ownership requires the new owner to submit a new agricultural exemption application. The County Appraisal District office manages and handles all Texas agricultural exemptions. While some counties may not require annual renewal after the initial application, it is important to contact your County Appraisal District office to verify their specific requirements. For your convenience, we have listed the links for each Texas county below.

Texas Ag Exemption For

Eligibility

Type of Livestock

Minimum Acreage Needed

Tax Savings

Maintaining the Exemption

Texas Ag Exemption For

Bee Colony Count

Transition from Ag Exempt

Minimum Acreage Needed

Building an Ag Use History

Application Deadline

Texas Ag Exemption For

Eligibility

TPWD Resources

Transferring Existing Status

Application Deadline

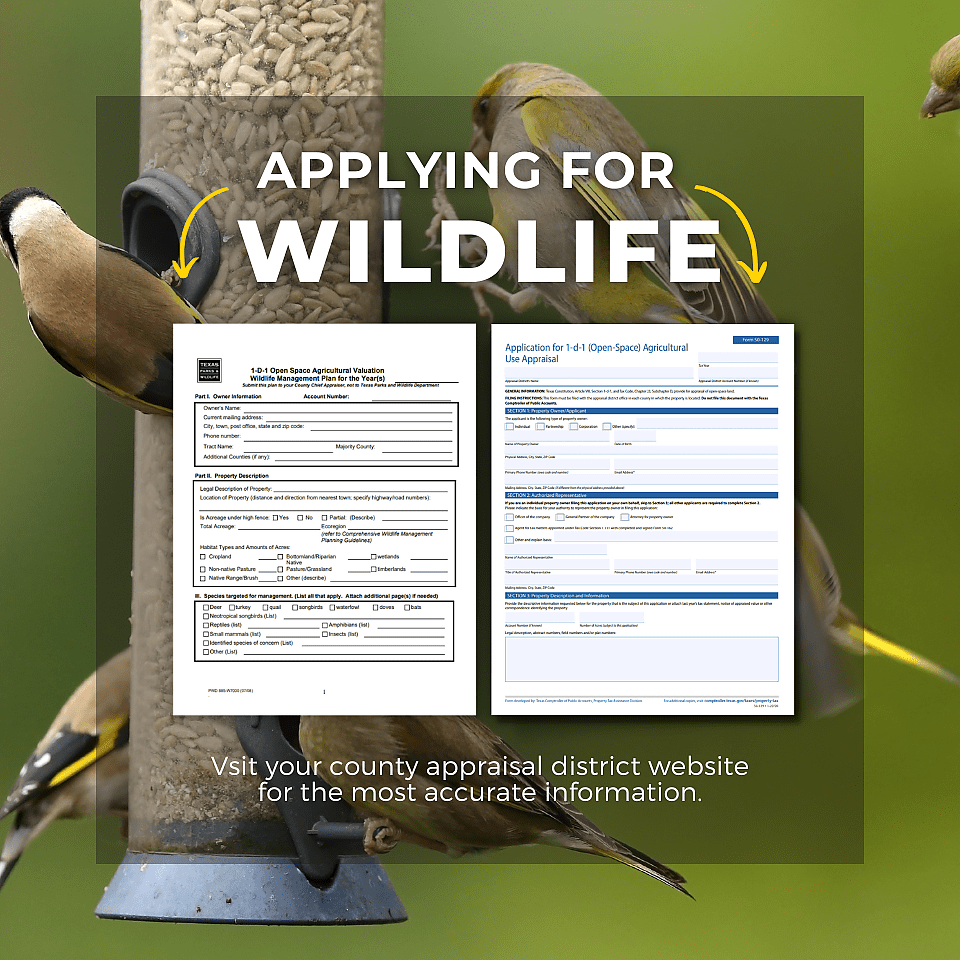

Wildlife management plan

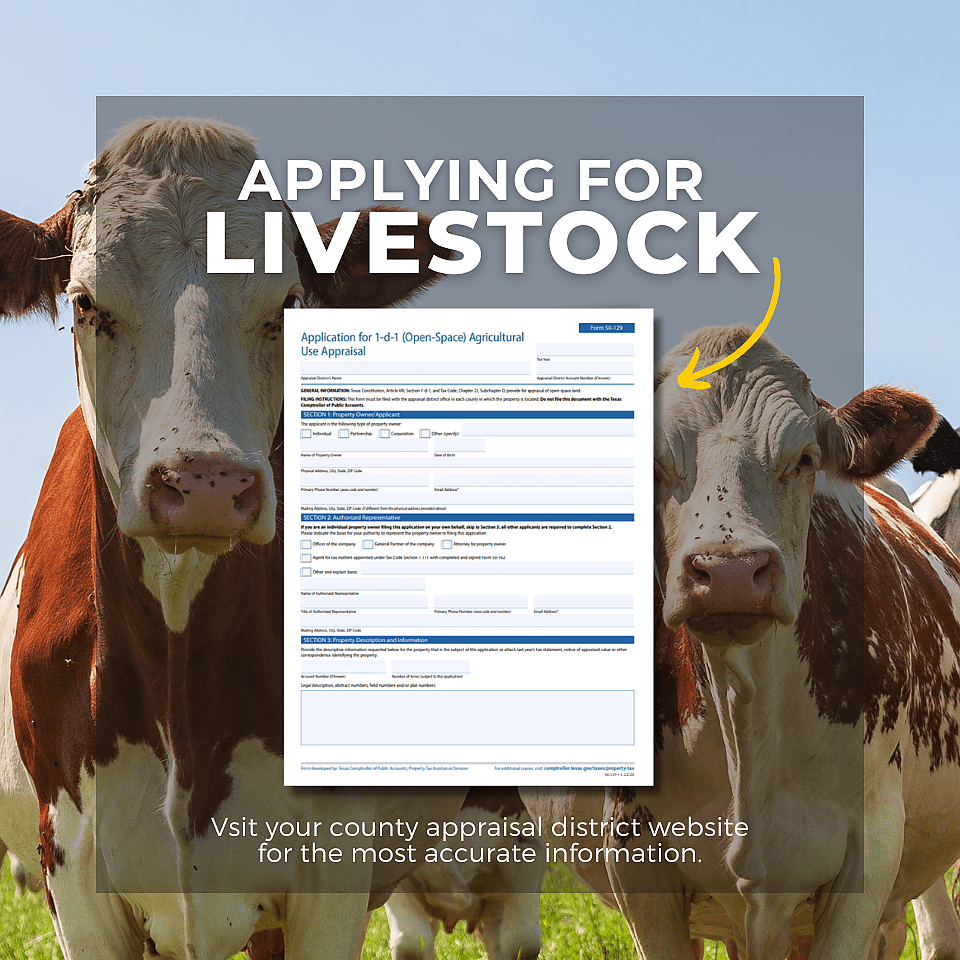

DOWNLOAD APPLICATION

DOWNLOAD WILDLIFE MANAGEMENT PLAN (THIS IS REQUIRED)

Contact Liberation Ranches for any questions about Texas land ownership.

An agricultural exemption is a unique valuation method. This means that if you own agricultural land, your property taxes are based on its productive agricultural value rather than its market value. Here is what you need to know for Texas livestock ag exemptions:

Hosting bees on your Texas land can be a great choice. Bees help pollinate crops and produce honey. It shows your commitment to the environment and offers educational and community benefits. Just be sure to follow local rules and understand the challenges. Here is what you need to know:

A wildlife tax valuation, known as a wildlife exemption in Texas, offers property owners the opportunity to maintain an agricultural tax rate on their rural property while managing it for native plants and animals. Here is what you need to know:

Failing to apply for or maintain agricultural exemptions in Texas can have significant financial consequences. Here is why it is crucial to take these exemptions seriously:

It is essential to apply for and diligently maintain agricultural exemptions, as well as other special valuations like wildlife or beekeeping exemptions, to avoid these potentially significant financial penalties. Ensuring your property continues to meet the criteria for these exemptions will help protect you from rollback taxes and other unwanted financial consequences.

If you are already taking advantage of an Ag Exemption, do not forget to renew your registration to keep your benefits. Ag or Timber Numbers must be renewed every four years, regardless of when the number was first issued.

Keep an eye on your mail for a renewal notice from the Texas Comptroller’s office, which includes all the information you will need. It is crucial to maintain this exemption because if you lose it, you could be responsible for taxes on the land up to five years prior–even if you didn’t own it then. Plus, your monthly payment will be affected and the loan company will have to escrow more money to cover the new taxes.

Here is how to renew:

If you don’t renew your ag exemption in time, you may have to reapply. For more information on when and how to reapply your ag, check out the FAQs below.

Contact Liberation Ranches for guidance and properties that simplify land ownership in Texas.